Best credit cards for paying insurance premiums in Singapore 2022

Premiums for medical insurance or life insurance can run into the hundreds each year or, if you're a bit older, thousands. That's why it's so worthwhile signing up for a credit card that rewards you when you use it to pay your insurance premiums.

Insurance isn't our idea of retail therapy. In a best case scenario, you don't use your insurance policy, which means that you paid insurance premiums for nothing.

In a worst-case scenario, you get to use your insurance policy, but it also means that you either landed in the hospital, got diagnosed with a terrible illness or died. But since paying for insurance premiums is inevitable, it's best to pay them with a credit card that allows you to claw something back.

Insurance premiums are often excluded from credit cards' cashback, air miles and rewards programmes. Even if your credit card promises to reward you for every cent you spend, insurance premiums might be excluded.

The easiest way to find out is to read your bank's Terms and Conditions sheet on the credit card's benefits. Often, googling [name of credit card] + [terms and conditions] will throw up the relevant PDF document, saving you from having to wade through the bank's website.

There will almost always be a list of exclusions that do not qualify for their cashback/miles/rewards. Check if insurance payments are one of them.

| Credit Cards | Benefits when you pay for insurance | Things to note |

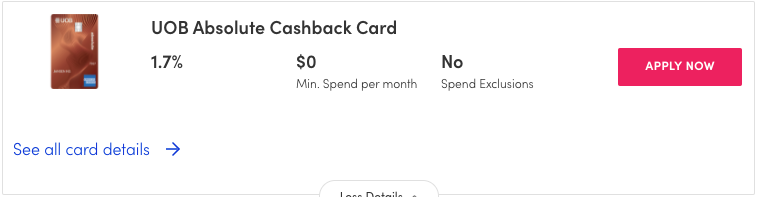

| UOB Absolute Cashback | 1.7 per cent cashback | No minimum spend |

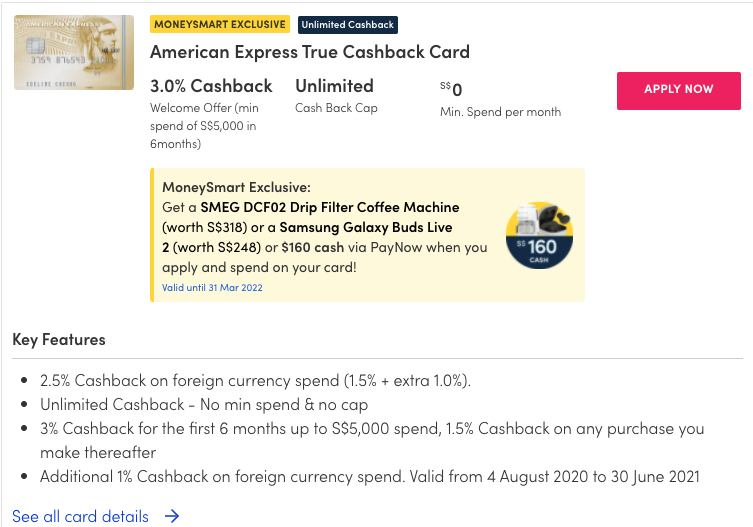

| Amex True Cashback | 1.5 per cent cashback | Three per cent cashback for first six months, capped at $5,000 spend |

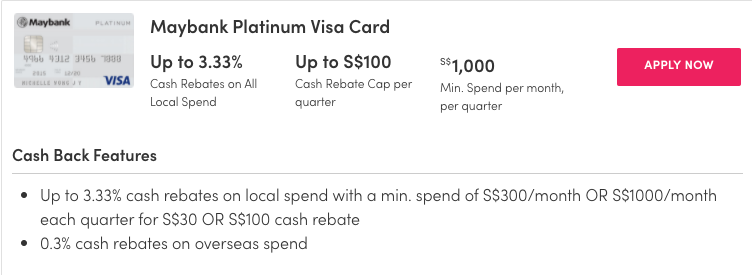

| Maybank Platinum Visa | Up to 3.33 per cent cashback quarterly | $30 cashback cap with min. spend of $300 $100 cashback cap with min. spend of $1,000 |

This card gives a maximum of three per cent cashback on all eligible spending, including insurance payments.

It's the only card with no insurer restrictions and offers immediate cashback in the same month's statement. However, the three per cent cashback is only offered for the first six months, and you can only earn that percentage for spending of up to $5,000. If you exceed $5,000, it will drop down to 1.5 per cent.

Still, if you can easily spend that much, go ahead and charge your insurance premiums to the card.

It's quite simple to use the American Express True Cashback Card. $5,000 spent in six months is not hard to achieve; most insurance premiums monthly payments and online shopping purchases should easily let you hit the cap.

If you want a simple and all-in-one cashback credit card that you're going to keep for the long term, your best bet would be the UOB Absolute Cashback credit card.

This card allows for insurance premium payments, unlike most cards out there, and you can just about charge anything onto the card and still get that sweet 1.7 per cent cashback - the highest in the market currently.

If you're into maximising your cashback, consider signing up for this card after you've exhausted the $5,000 limit for the above mentioned Amex True Cashback card.

Literally charge most of your expenses onto this card - bills, insurance premiums, online shopping, whatever - and then reap the cashback with your monthly statement.

This card is suitable for people wanting to save themselves a headache and have something simple to use.

If you find yourself making a lot of foreign currency purchases (shopping on Amazon US for example) and want one card to also pay your bills and insurance premiums, the Maybank Platinum Visa card is just for that.

However, the cashback is on a quarterly basis and is capped at $100 if you hit the minimum spending requirement of $1,000. This amount is quite easy to hit especially if it's on a quarterly basis.

It happens ALL the time - find yourself window shopping on Amazon Singapore, and you come across something you like but it's only available on Amazon US.

Charge that purchase in USD to your Maybank Platinum Visa and then automate your insurance premiums to this card. Reap the $100 quarterly cashback when it's time!

This article was first published in MoneySmart.