Here's how to earn that extra money by lending your Singapore shares

As investors of stocks, we make money through capital gains and dividends .

However, did you know there’s another way to get some side income through the Singapore shares we hold under our CDP accounts?

Enter the Singapore Exchange’s Securities Borrowing and Lending (SBL) programme…

Here’s a summary of the SGX SBL programme:

The programme allows you to lend your shares to a borrower

In turn, you will receive a lending fee (exact fee for a particular stock can be found on SGX’s website)

There are specific criteria to meet for your holdings to be added to the lending pool

Even if your shares are lent out, you will still be eligible for the economic benefits of share ownership (such as bonuses, rights issues, and dividends)

One downside to SBL is that when your shares are on loan, the legal ownership is temporarily transferred to the borrower and therefore, you will not be allowed to attend the company’s annual general meeting, for instance

According to SGX’s website, the SBL is a programme that “involves the temporary transfer of securities, together with the transfer of title and associated rights and privileges, from a lender to a borrower”.

What this means is that you can lend your shares that’s parked under CDP to someone else. That person you are lending to may be trying to short the stock.

When someone shorts a stock , he or she is selling the stock first, hoping to profit by buying it back at a lower price at a later date.

If your shares are held in your CDP account, you can participate in SBL by submitting this form. Once approved, you can participate as a lender and CDP will let you know if someone borrows your stock.

To be added to the lending pool, your holdings must meet the following criteria:

For shares priced $1 or below, you must own a minimum of 10,000 units; and

For shares priced more than $1, you must own a minimum of $10,000 in value.

[[nid:502081]]

The main benefit of lending your shares is that you will be paid a lending fee, which can potentially enhance the yield of your stock portfolio.

Previously, the lending fee rate was fixed at 4 per cent per year, while the borrowing fee rate stood at 6 per cent.

Since December 2, 2019, the borrowing rates for Straits Times Index stocks, Real Estate Investment Trusts (REITs) , and business trusts are at 0.5 per cent per annum while the rest of securities stand at 4 per cent (rates will be reviewed periodically).

The lenders’ fees are calculated based on 70 per cent of the borrowing fee.

Lending Fee = Rate % x Loan Value x Days / 365

Where Rate % = Prevailing lending rate

Loan Value = Number of shares x closing price for the day

Days = Loan duration

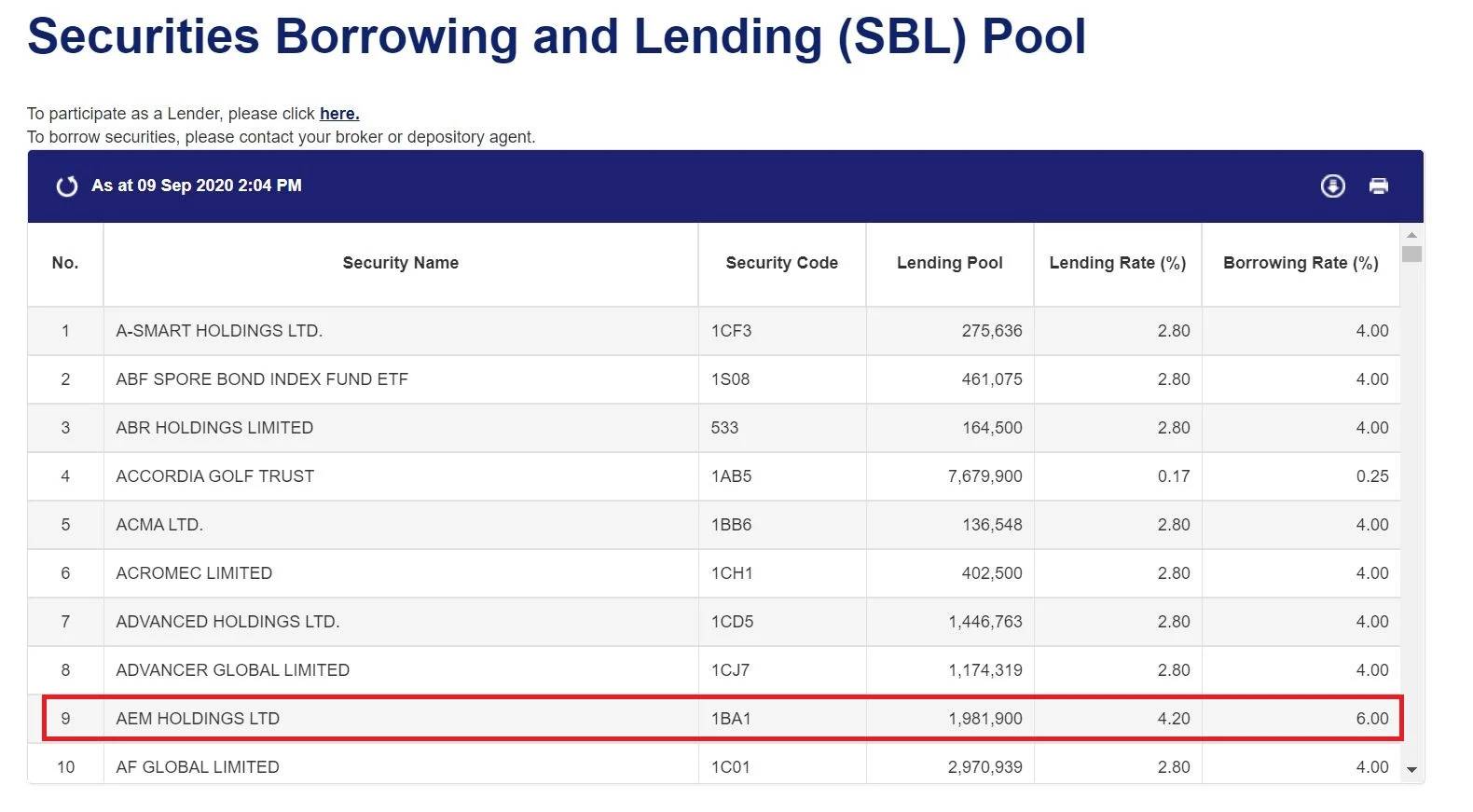

You can find out the exact lending and borrowing rates from SGX’s website here.

For example, if you own shares in AEM Holdings Ltd, you can lend it out and earn 4.2 per cent per annum.

Other benefits of the SBL programme include:

No participation cost (it’s free to register as a lender)

Ability to sell your shares anytime (no lock-in period)

Being still eligible for economic benefits of share ownership (such as bonuses, rights issues, and dividends)

[[nid:501808]]

When your shares are on loan, the legal ownership is temporarily transferred to the borrower until the shares are returned to you.

Therefore, you won’t have voting rights to the shares and would also not be allowed to attend annual general meetings (AGMs) as your name won’t be registered in the company register as a shareholder.

Another downside is that if a borrower fails to return the loaned shares to you by the due date, you may receive your loaned shares or sales proceeds late when you have indicated the intention to terminate the loan, either by recalling or selling the loaned shares.

You can read the full explanation of risks under “Securities Borrowing and Lending” of the CDP frequency asked questions (FAQs).

In my opinion, the SBL is a great way to earn some extra money from our stock holdings.

Even when we lend out our shares, we will still receive dividends and would be entitled to the other corporate actions .

This article was first published in Seedly. All content is displayed for general information purposes only and does not constitute professional financial advice.