Shoebox units: A performance review over the past 10 years

Go into any showflat as a single, and the first unit you’ll be guided to is the shoebox units; more pleasingly called a “compact unit” these days.

These units – which are typically defined as 500 sq. ft. or under – are often marketed as the ideal choice for “new investors”. They’re also the low-hanging fruit of any sales launch, and they’re often pushed first; this helps to boost the sales numbers, and give the perception of a higher price per square foot.

They are also popular. So popular, in fact, that in 2018 URA had to pass restrictions that would limit the number of shoebox flats in certain neighbourhoods.

At the time, it was common to hear that the lower supply was good for shoebox investors.

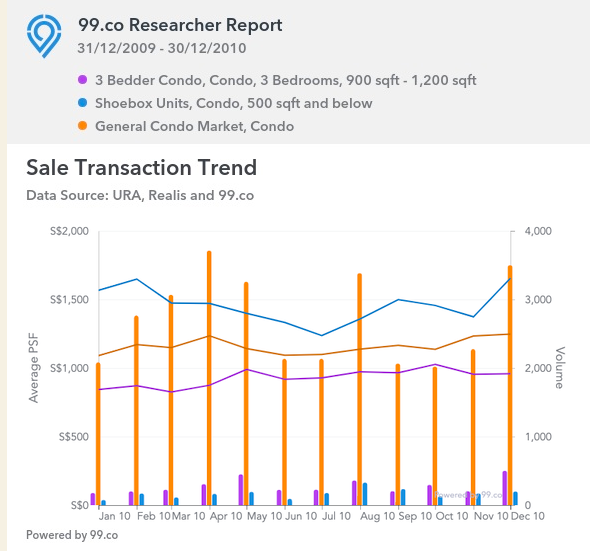

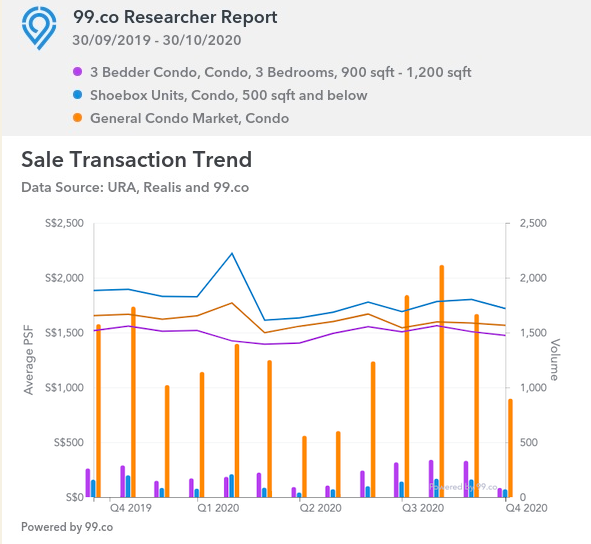

But how well do shoebox units appreciate, compared to the overall market for condos? Do they outperform the typical family-sized three-bedders? We’ve taken a look at the numbers over the past years:

We compared the appreciation of the following:

We compared the average transaction prices for the year 2010, to the average transaction prices in 2020.

On a price per square foot basis:

Shoebox units have increased from an average of $1,456 to $1,797 psf. This is a 23.4 per cent increase.

Three-bedroom units have increased about 61.4 per cent, from $926 to $1,495 psf.

The condo market, in general, has seen prices increase as well on a psf basis, from $1,158 to $1,614 psf. This is an increase of 39.3 per cent.

In terms of quantum, shoebox units have appreciated 33.1 per cent over the past decade; from $616,217 to an average of $820,402 today.

Three-bedder family units have appreciated 49.6 per cent, from $1,029,614 to an average of $1,540,475 today.

Overall, condo prices have risen 12.6 per cent, from $1,414,746 to an average of $1,594,054 today.

In the context of the wider Singapore condo market, shoebox units appear to have performed “as advertised”. They have come out ahead of the overall condo market, lending some credence to the argument that their low quantum provides room for appreciation.

However, the common family-sized three-bedders have managed to outperform shoebox units, as well as the overall market, by a wide margin.

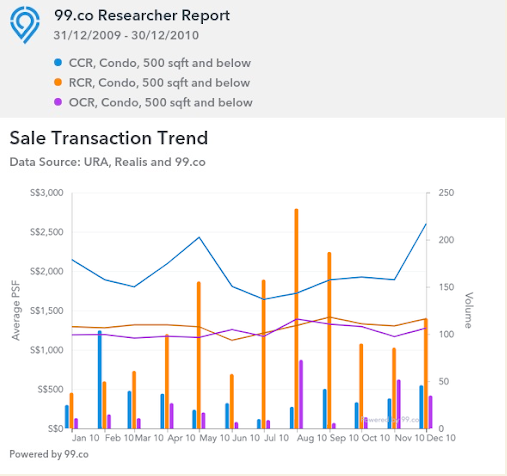

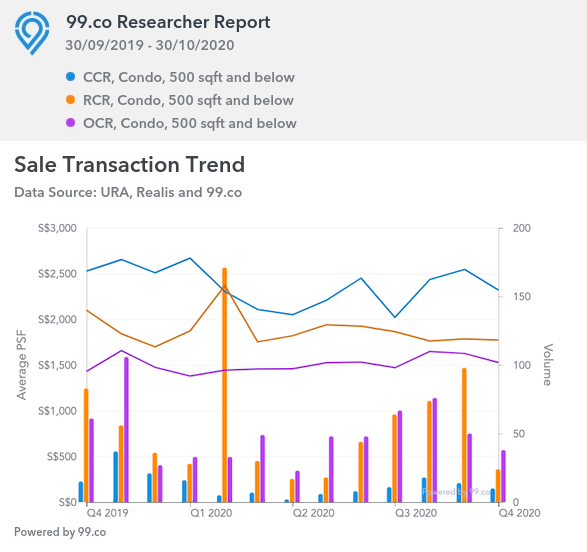

Shoebox owners feature a higher proportion of investors / landlords, who don’t occupy the unit (they are too small for most families). As such, a favoured location for shoebox units is within the Core Central Region (CCR) or city fringe (RCR).

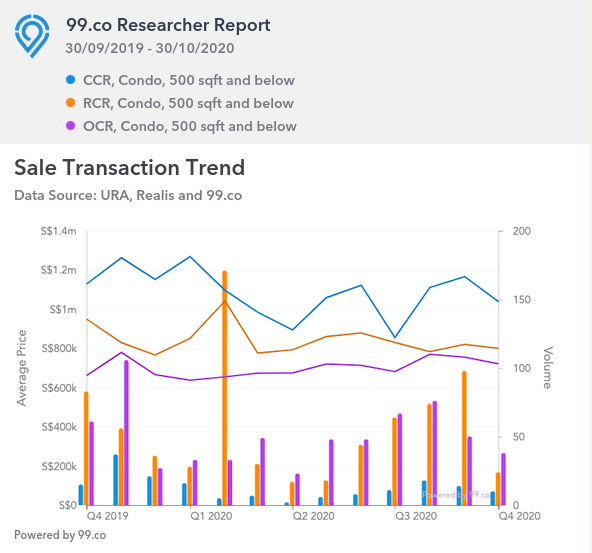

Nonetheless, there are shoebox units in the Outside of Central Region (OCR) as well. In the next graph, we examine:

Within the CCR, shoebox units have appreciated 19.2 per cent, rising from $1,987 to $2,369 psf.

The RCR saw the highest appreciation on a psf basis, rising around 45 per cent from $1,300 to $1,885 psf.

The OCR saw prices rise about 22.8 per cent, from $1,229 to $1,510 psf.

In the CCR, prices have risen around 29 per cent, from an average of $842,545 to $1,087,655.

The RCR has seen prices rise by about 54.4 per cent, from an average of $547,001 to $844,773.

In the OCR, prices appreciated by close to 28 per cent, from an average of $547,018 to $700,688.

First, CCR shoebox units took a steep dive after new cooling measures in 2018, which raised the Additional Buyers Stamp Duty (ABSD).

As we mentioned above, shoebox units – particularly those in the CCR – are often bought as pure investment assets. Many prospective buyers would be purchasing them as a second property.

For Singapore citizens, this would mean an ABSD of 12 per cent, or over $98,448 on the current average price of $820,402. This is difficult to justify for most investors; the effect is likely compounded this year, as Covid-19 could reduce the number of foreign tenants renting in the CCR.

Second, the RCR seems to be the best location for shoebox units, in terms of pure appreciation. This runs contrary to a common perception: that shoebox units only appreciate well in the city centre, and that the OCR is the “worst” place for them.

In fact, the appreciation between CCR and OCR shoebox units is about one percentage point (and OCR units require a much lower cash outlay).

There are two challenges on the horizon for shoebox units.

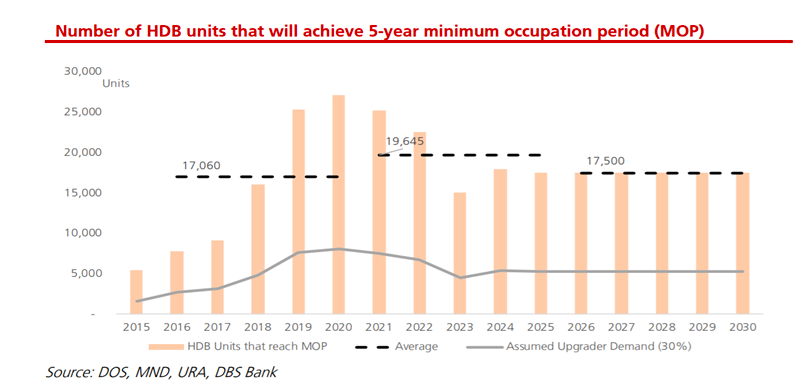

The first is the recent buyer demographic. Since 2019, private home sales have been buoyed by HDB upgraders.

In addition, an average of 17,000 to 19,000 flats are expected to reach their Minimum Occupation Period (MOP) annually, over the next 10 years (by contrast, the 10-year average between 2008 to 2018 was only about 9,000 flats).

The problem for shoebox flats is that this buyer demographic has less interest in them. Most HDB upgraders are families, and a 500 sq. ft. unit is out of the question.

As such, the only viable buyers – out of the throng entering the market – are the smaller group of lifelong singles, or retirees (who sometimes sell their bigger flat and move into a condo, as the children have left).

This could greatly narrow the number of prospective buyers.

Second, the Covid-19 downturn is likely to mean fewer foreign tenants, or tenants with reduced housing allowances and expatriate packages. This could cause investors to reconsider a shoebox unit; we shouldn’t forget they need to justify the ABSD on top of this.

As such, the next most viable group of buyers may also show lacklustre interest.

There’s an argument that new URA restrictions will limit the number of shoebox units, lowering supply.

[[nid:507337]]

You may hear, in the occasional sales pitch, that URA has passed restrictions on the number of shoebox units that can be built. It’s then theorised that restricted supply will help to maintain prices.

The theory is a little arguable. It’s true that URA, in 2018, passed measures that will lower the number of shoebox units developers can build. However, we shouldn’t ignore why URA chose to do this in the first place:

In 2012, there were only around 2,500 shoebox units in Singapore. In 2018, this number had increased to 28,000.

Shoebox units had gone from making up one per cent of our private housing stock, to 8.7 per cent, in just six years.

All of those previously built shoebox units are not going to disappear, just because URA passed new regulations in 2018. The supply remains in the market. As such, it’s questionable if the new restrictions will create such a strong scarcity effect.

While shoebox units remain viable investments, you still need to be cautious if you are looking to make a purchase.

2020 has been a strange year, which will have consequences for the decade to come. Whatever their past performance, it’s time for home buyers and investors to rethink the assumptions regarding shoebox units.

This article was first published in Stackedhomes.