Starting your company in Singapore: A guide to all the costs

Being the Chief Everything Officer of your own start-up requires you to know the costs at every step of the way, from ACRA registration to the first-year upkeep.

Having been forced to work from home for weeks, it might have shown you that you have the discipline and motivation to take care of business in a vacuum.

From there, you might have also started wondering if you can fly solo and start the next big thing.

Being able to resist clicking on ‘Next Episode’ in Netflix to write up that project proposal (even when nobody’s looking over your shoulder) is kind of a big deal.

It demonstrates an ability to delay gratification, which is a crucial trait that separates the salaried masses from high-flying entrepreneurs.

Now that we’ve fired up your enthusiasm to be your own boss, here’s all you need to know about how to start your own business in Singapore, and how much it’ll cost.

| Item | Cost |

| Self-registration – Name reservation ($15) – Business entity registration ($100) |

$115 |

| Agency package | $300 to $1,000* |

| Licenses | Varies according to sector |

The first step to starting your own business is to register with the proper authorities.

In Singapore, all business registrations are handled by the Accounting and Corporate Regulatory Authority (ACRA).

You can easily register your business online via Bizfile.

You’ll start by selecting the structure of the business entity you are registering (for example, sole proprietorship, partnership, private limited, limited liability partnership, etc).

Afterwards, you’ll be asked to provide:

Once your business has been incorporated, you’ll need to apply for the proper business license before commencing operation.

Costs at this stage are relatively low. Self-registration is the lowest-cost option: you’ll need only $115 to register your business name and entity with ACRA.

If you require additional services (such as a virtual address) or don’t want to mess with the paperwork yourself, you can hire an agency to help you.

There are various packages available, catered to different needs. Expect to spend between $300 and $1,000 for business incorporation services.

As for licenses, fees vary according to the type you require. On average, license fees cost a few hundred dollars.

You can find out more about business licenses at the GoBusiness licensing portal.

| Method of financing | Cost |

| Bootstrapping | No cost |

| Getting an investor | Investor returns |

| Bank loan | Loan interest charges and registration fees |

There are different ways to finance your business startup costs, and we’ll discuss three of the most common ones:

Bootstrapping refers to the practice of funding your business startup costs with your own savings, credit lines and internal sources of funds, such as business revenue.

Strictly speaking, there is no ‘cost’ involved in bootstrapping – apart from the personal cost to your own savings – and any profits you make are yours.

Getting an investor to help fund your business is a potentially beneficial arrangement.

You’ll raise the capital you need, and can have different ways to repay your investors (shares, dividends, debt with interest, etc).

Be sure you understand clearly the type of returns your investor is seeking, and the timeline, before signing on the dotted line.

A third option is to apply for a business loan from the banks or the government.

This is a more straightforward option than working with an investor.

You’ll receive the capital you need, but also will be bound to repay the loan on a strict schedule. The cost of a business loan is the cost of borrowing (i.e. the interest charges and the application fees).

| Business set-up | Cost |

| Rental deposit | 1 – 2 months deposit plus first month’s rent |

| Business equipment, furniture, renovation | Tens to hundreds of thousands |

| General liability insurance | Few hundreds to a thousand plus per year |

| Hiring employees | 10 per cent to 20 per cent of first year’s salary |

The next step is to set up your business.

The key activities are finding and renting a suitable business space, procuring business equipment and furniture, buying business insurance, and hiring employees.

When you locate the ideal unit for your business, you’ll need to lock it down by signing a lease agreement.

It is customary for your landlord to collect a deposit amounting to one month’s rent per year of rental, plus the first month’s rental.

If you’re leasing the space for 3 years for $5,000 a month, you’ll need to make an upfront payment of 3 months + 1st month’s rent = (3 x $5,000) + $5,000 = $20,000 when you sign the lease.

Depending on the condition and layout of your rented space, you may need to carry out some light renovation, perhaps to add more powerpoints, create meeting rooms with partitions, or just to give the place a fresh coat of paint.

You’ll also likely need to purchase or lease furniture like desks, cabinets and chairs, as well as equipment such as computers and printers.

Renovation costs will vary according to the nature of your business.

A standard office for five may cost only a few thousand to renovate and furnish, while a lifestyle cafe or themed bar may incur renovation costs in the tens of thousands.

ALSO READ: 5 reasons why some businesses fail

It is also a good idea to purchase insurance to protect yourself and your employees.

In fact, most landlords insist on having general liability insurance before they’ll rent the space to you.

A standard general liability insurance with $1 million in coverage will cost you at least a few hundred dollars a year in premiums.

Finally, you may also need to hire employees to help you run your business.

For senior or specialised positions, recruitment services can go up to 20 per cent of the candidate’s annual salary.

For entry-level positions or those with more general scopes, recruitment costs will be lower.

| Business operations | Cost |

| Overheads (payroll, rent, etc.) | Tens to hundreds of thousands |

| Raw materials | Varies according to sector |

| Marketing | 10 per cent of projected annual revenue |

| Accounting | Hundreds to thousands |

Once your business starts running, there’ll be several costs you’ll need to manage on a constant basis.

Payroll, office or shop rental, utilities, equipment leasing and other overhead costs are likely to make up a major part of your business expenses each month.

Depending on the size and location of your space, how many employees you have, and the type and nature of your business, you can expect to spend between tens of thousands and hundreds of thousands per month.

Raw material costs can also be significant, especially if your business requires price-sensitive commodities (like how a printing firm is affected by the cost of paper), or you’re in the F&B business in which shelf life of food needs to be managed carefully.

ALSO READ: How to build a highly successful start-up - Marcus Tan of Carousell

Marketing is another important business expense that should not be overlooked.

As a general rule, you should set your marketing budget at 8 per cent to 10 per cent of projected revenue.

So let’s say you’re holding a sales campaign with a target of $300,000 in revenue, your marketing budget for the campaign should be roughly $25,000 to $30,000.

If your projected revenue for the year is $1 million, then you should set aside $80,000 to $100,000 in marketing for the year.

You should also keep track of how your financials are looking.

You may consider getting a professional accountant to help you straighten out your accounts.

This will provide two benefits: helping you to file your taxes correctly, while providing you with a clear grasp of the health of your business.

No two businesses are the same, and you may be wondering how much you’ll actually need to start your dream business.

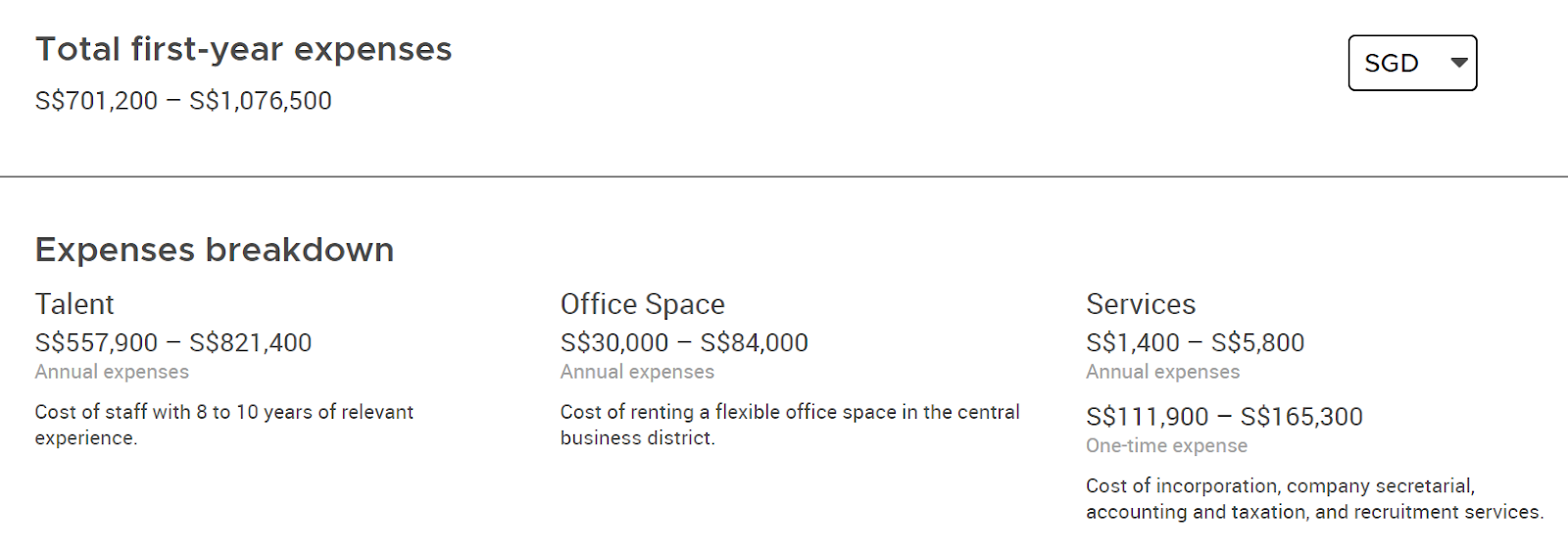

In that case, here’s a tool you’ll want to check out: Business Cost Calculator by the Economic Development Board (EDB).

By inputting a few key details, you can quickly find out the expected first-year costs of your business.

For the fun of it, we went ahead and did up a costing sheet for a small cafe startup with five staff.

Here’s what we found.

Up to a million dollars? That’s a lot of money!

We’d think some of the costs are a little stretched.

For example, under talent, the illustration is done using the assumption of senior staff with 8 to 10 years experience rather than, say, fresh-grads.

Of course, EDB’s calculator is just a tool to generate a quick estimation; you should do your own research and crunch your own numbers if you’re serious about starting up your own business.

This article was first published in SingSaver.com.sg.