UOB Lady's Card: New design and rewards earn rates sweeten the deal for this revamped card

The UOB Lady's Card used to have this memorable tagline: "The men don't get it". Now, the men do get it-the UOB Lady's Card is open to both women and men, and has emerged as one of the strongest rewards credit cards in Singapore.

This card gives you up to six miles per dollar (mpd) on spending in a category of your choice, plus benefits such as free e-Commerce protection for online purchases and female cancer coverage with the UOB Lady's Savings Account.

Let's take a look at the revamped UOB Lady's Card and check out its benefits.

| UOB Lady’s Card Review—Is it MoneySmart? | ||

| Overall: ★★★★☆Best for: Both ladies and gentlemen who spend largely on one category (Beauty & Wellness, Dining, Entertainment, Family, Fashion, Transport and Travel), up to a cap of $1,000 a month. | ||

| Category | Our rating | The deets |

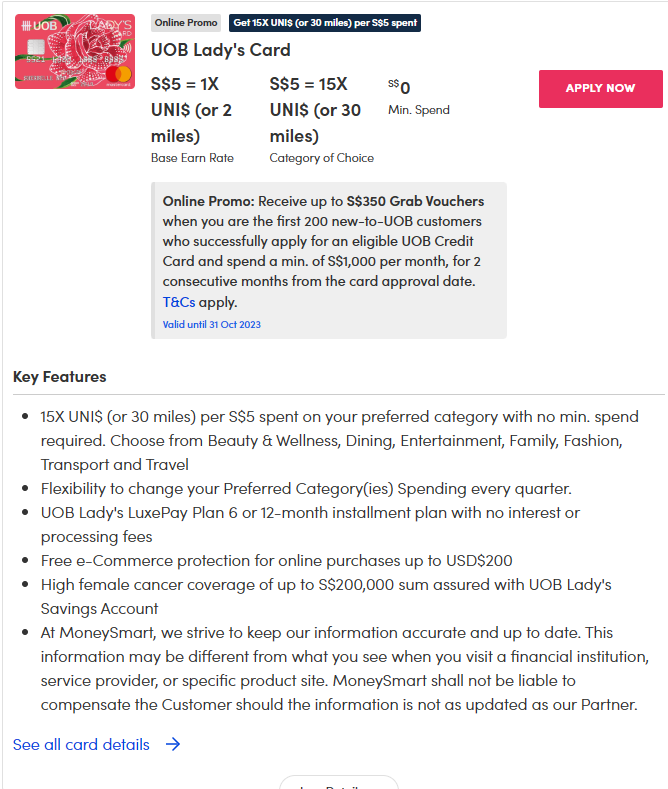

| Earn rates: UNI$ | – S$5 = 1X UNI$ (or 2 miles) – S$5 = 15X UNI$ (or 30 miles) on a preferred category of your choice with no min. spend: Beauty & Wellness, Dining, Entertainment, Family, Fashion, Transport and Travel. Capped at 2,800 UNI$/month (S$1,000 spend). – You can change your preferred category every quarter. – Convert your UNI$ into air miles at the conversion rate of UNI$1 = 2 miles | |

| Earn categories | ||

| Annual fees and charges | ★★★★☆ | S$194.40 annual fee (first year waived)First Supplementary Card free, $97.20 for subsequent Supplementary Cards. |

| Accessibility | ★★★★☆ | Minimum income requirement: $30,000 (Singaporeans and PRs, salaried workers) / $40,000 (Singaporeans and PRs who are self-employed or commission-based; non-Singaporeans) |

| Extras/periphery rewards | ★★★☆☆ | – UOB Lady’s LuxePay Plan 6 or 12-month installment plan with no interest or processing fees. – Free e-Commerce protection for online purchases up to USD$200 – High female cancer coverage of up to S$200,000 sum assured with UOB Lady’s Savings Account |

| Sign-up bonus | ★★★☆☆ | Get up to S$350 Grab Vouchers from UOB when you are the first 200 new-to-UOB customers who successfully apply and spend a min. of S$1,000 per month, for 2 consecutive months from the card approval date. You’ll also stand to receive a ASUS Vivobook x BAPE ® (worth S$2,349) OR a Sony PlayStation®5 Disc Console (worth S$799) OR a Nintendo Switch OLED (worth S$549) when you successfully apply for an eligible UOB Credit Card through MoneySmart and meet the Giveaway eligibility criteria. Valid till 17 Oct 2023. |

See our credit card ranking rubric to find out how we rank credit cards.

Don’t forget to check out all our Singapore credit card reviews.

| UOB Lady’s Card | |

| Annual fee & waiver | $194.40 (waived for 1 year) |

| Supplementary annual fee | First supp card free, subsequently $97.20 |

| Interest free period | 21 days |

| Annual interest rate | 26.90per cent |

| Late payment fee | $100 |

| Minimum monthly repayment | 3per cent or $50, whichever is higher |

| Foreign currency transaction fee | 3.25per cent |

| Cash advance transaction fee | 8per cent |

| Overlimit fee | $40 |

| Minimum income | $30,000 (Singaporean) / $40,000 (non-Singaporean) |

| Card association | MasterCard |

| Wireless payment | MasterCard PayPass, Apple Pay, Samsung Pay, Android Pay, UOB Mighty Pay |

Note: There’s a higher tier version of this card called the UOB Lady’s Solitaire Card for minimum income of $120,000. It has better perks (e.g. 2 preferred spending categories! Complimentary travel insurance!) but it’s also a lot more expensive, not to mention out of reach of normal plebeians.

First of all, it has to be said that the UOB Lady's Card's new design, which is done by local fashion designer Priscilla Shunmugam, is actually quite pretty. UOB is obviously angling for Instagrammability, and I think they've succeeded. (Trigger warning for trypophobics though: It has a lot of dots.)

On to the card itself. As mentioned, this is a rewards credit card that lets you earn 15X UNI$ (UOB rewards points) on any one spending category of your choosing. That's equivalent to $1 = 6 air miles. Points are awarded for every $5 you spend.

This is an impressive earn rate. Only a few other credit cards let you earn even four miles per dollar, and some of these are fairly restrictive.

The UOB Lady's Card, on the other hand, lets you choose your favourite spending category from the following choices:

The categories are a tad reductive, but I'm not complaining since you do get to choose which one earns you the bonus cashback. To do so, you need to enrol online. You can also change your preferred category every calendar quarter, which is a nice touch.

UOB has removed the absurdly high minimum spend of $3,000 per month in order to earn rewards. Like all other rewards cards on the market, there's now no minimum spend.

There is, however, an expenditure cap of $1,000 a month if you're a regular UOB Lady's Card holder, or $3,000 if you're a Solitaire or Solitaire Metal Cardmember. If you spend more than that on your bonus category, you won't earn bonus points. The base rate of 1 UNI$ (or 2 miles) per S$5 spent still applies.

Are you new to UOB, i.e. you don't have a UOB credit card? You can walk away with S$350 worth of Grab vouchers from UOB. To snag these vouchers, be among the first 200 new-to-UOB customers to apply for the UOB Lady's Card and spend S$1,000 per month for two consecutive months from the card approval date.

Plus, you'll also stand to receive a Asus Vivobook x BAPE ® (worth S$2,349) or a Sony PlayStation®5 Disc Console (worth S$799) OR a Nintendo Switch OLED (worth S$549) when you successfully apply for an eligible UOB Credit Card through MoneySmart and meet the Giveaway eligibility criteria.

Note that you can take advantage of this promotion with other UOB credit cards too, not just the UOB Lady's Card, so you might want to check out what other credit cards UOB has to offer first. Having a UOB Lady's Card also entitles you to discounts at partner merchants.

Finally, there's also a 0per cent interest instalment plan available called LuxePay, so you can pay off your immense shopping bills over six or 12 months. But that's not necessarily a good thing-read this article for the dirty truth about on instalment plans. Hey man, UOB, there's nothing glamorous about overspending on your credit card.

Credit goes to UOB for rather belatedly realising that not all "ladies" are tai tais and shopaholics. With the credit card revamp, the UOB Lady's Card now lets you choose which spending category you'd like to be rewarded in. Now that's a powerful rewards card.

Here are some others you might want to check out.

Citi Rewards Card – If you constantly need new clothes, the Citi Rewards Card lets you earn air miles faster so you can take your OOTDs in Seoul or Melbourne in no time. You get 10X rewards when you spend on shoes, bags and clothes, and at department stores, capped at 10,000 points per statement month.

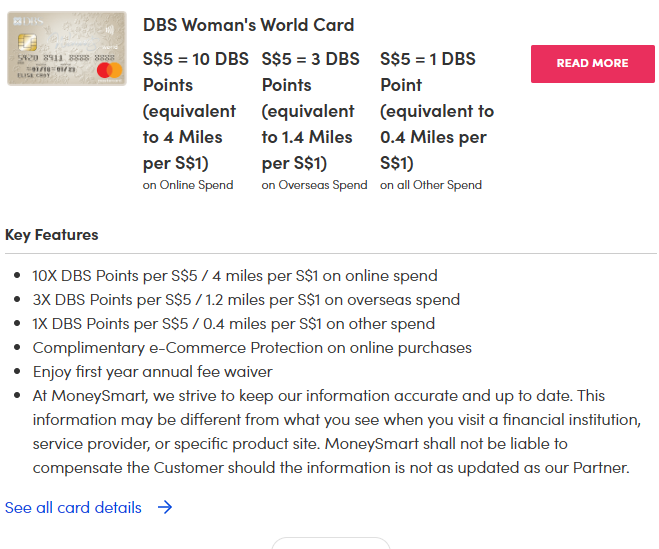

DBS Woman’s World Card – If you have a high enough qualifying income of $80,000 p.a. (we hope you do if you’re planning to spend $3,000 a month on shopping) for the DBS Woman’s World Card, you can get 10X rewards on pretty much any kind of online spending. It’s not limited to shopping; even things like food and grocery delivery and travel bookings qualify.

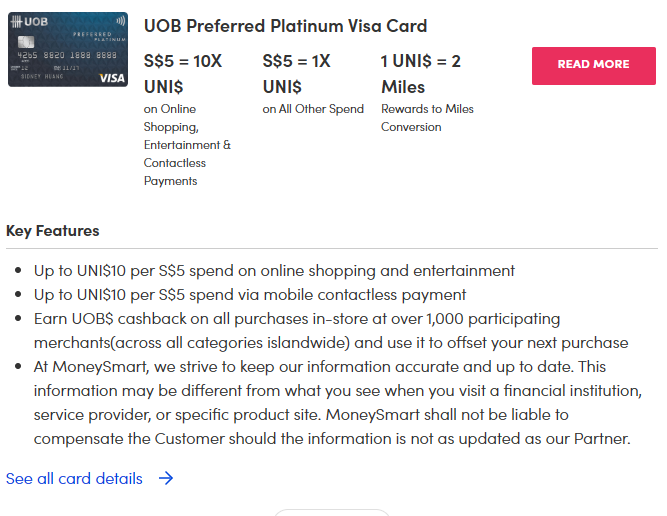

UOB Preferred Platinum Visa Card – UOB’s own Preferred Platinum card gets you 10X rewards on online shopping (plus entertainment, groceries and food delivery) and offline when you use Visa payWave (accepted at mainstream stores).

| Is that credit card MoneySmart? Our MoneySmart credit card ranking rubric | |

| Category | Our rating |

| Overall | The average rating for the credit card on the whole, calculated from the ratings for the individual categories below. Plus, we’ll give you a one-liner on who we think the credit card is best suited for. |

| Earn rates: Air miles / Cashback / Rewards points | Air miles ✈️✈️✈️✈️✈️ / Cashback / Rewards points . This category looks at the depth rather than breadth of earn rates.

|

| Earn categories | This category looks at the breadth rather than depth of your earnings.

|

| Annual fees and charges |

|

| Accessibility | Minimum income requirements:

|

| Extras/periphery rewards | These include:

|

| Sign-up bonus |

|

ALSO READ: 12 best cashback credit cards in Singapore (2023)

This article was first published in MoneySmart.