'I went into a state of shock': Family loses $150k life savings after trying to purchase eggs on Facebook

PUBLISHED ONDecember 28, 2023 4:59 AMByAshwini Balan

PUBLISHED ONDecember 28, 2023 4:59 AMByAshwini BalanA family of five had $150K of their life savings wiped out after trying to purchase eggs on Facebook, CNA reported on Wednesday (Dec 27).

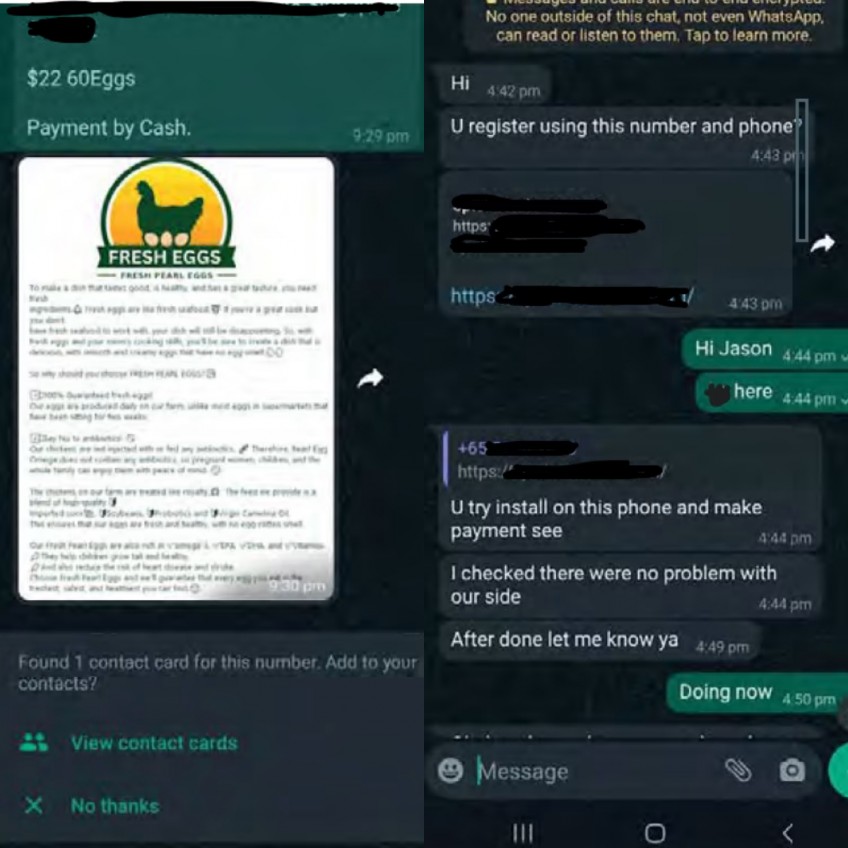

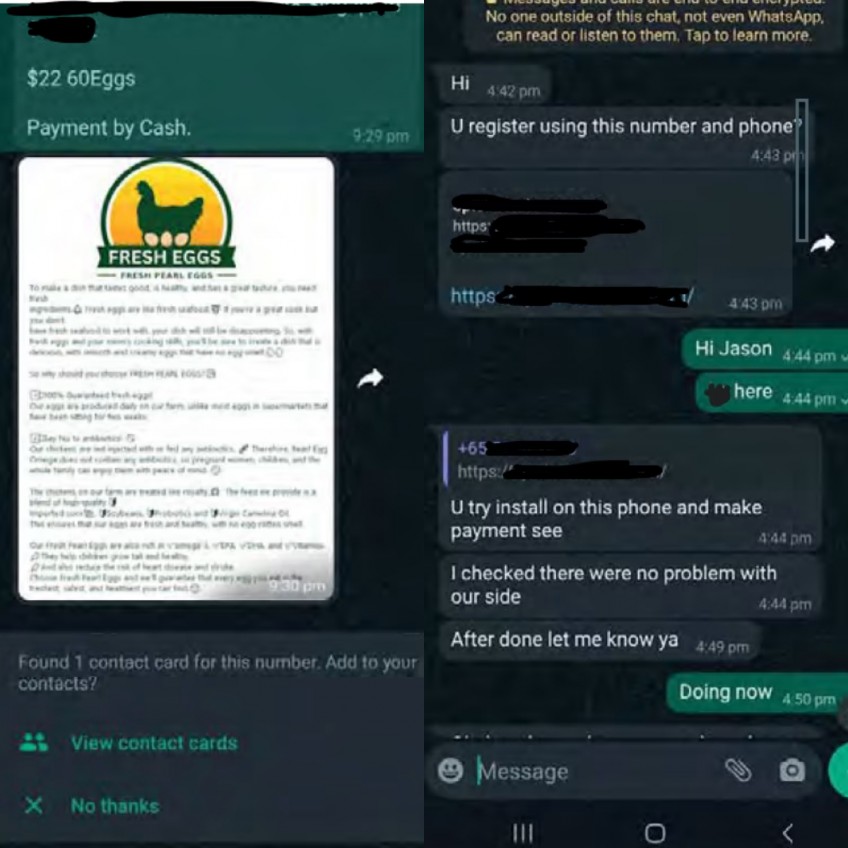

The incident took place on Nov 26 when Singh, who declined to be named in full, said his wife chanced upon an advertisement selling organic eggs on Facebook.

Thinking that the deal for 60 eggs was good, the couple decided to go ahead with the purchase and clicked on an "order" button. They were then directed to a WhatsApp chat with a "seller" who went by the name of Jason.

According to Singh, Jason told them to make a deposit via an app, with the remainder to be paid upon delivery.

Jason then sent a link and instructed the couple to download the mobile app, which they did as told.

Upon placing the order, Singh told CNA that the payment page closely resembled UOB's. He proceeded to key in their UOB bank details but transaction failed.

When the couple decided to cancel the order, Jason insisted on proceeding with the delivery, which he claimed would be on the next day.

On Nov 27, Singh received a call from a UOB customer service officer asking about a large credit card transaction made from his account which he denied.

Upon logging into his UOB and DBS bank accounts, Singh discovered that his entire funds were wiped.

"When (I saw) zero, zero, zero I think I went into a state of shock. Like I became a zombie. I didn't know what to do," said Singh told CNA.

The couple immediately made a police report and notified the banks involved as well.

"Can anyone imagine their life savings being completely wiped out in a single day?" Singh lamented.

Singh said there were a number of outgoing $15,000 transactions from his UOB account, while nearly $30,000 was siphoned from his DBS one.

He later said that the banks should take some responsibility over the incident.

"I'm not the one who went down and withdrew the money and gave it to the scammer ... I wasn't even aware this thing was happening," he said.

The police told AsiaOne that a report has been lodged and investigations are ongoing.

UOB and DBS told CNA that they are aware of Singh's case and are in contact with him.

In December alone, some 132 victims have been scammed at least $314,000 through fake buyer phishing scams, The Straits Times reported.

Police have observed that the scammers would pose as sellers of various services and send victims a link to install an Android application and grant the app certain permissions to access their phone.

When making payment, victims' internet banking credentials would then be stolen by the malware's key-logging function, which allows scammers to access the banking app on the victims' phones and perform unauthorised transactions.

The police advises members of public to take precautions such as using the ScamShield app, enabling security features like transaction limits for Internet banking, and setting up two-factor authentication.

One can also check for signs of scams via official sources such as the Anti-Scam Helpline or the Scam Alert website.

The police also urged people to report any suspicious user to the e-commerce platform and any fraudulent transactions to the bank immediately.

For more information on scams, members of the public can visit www.scamalert.sg or call the anti-scam helpline on 1800-722-6688.

ashwini.balan@asiaone.com