‘Without that first loan, we wouldn’t be where we are today’: OCBC’s new programme helps women entrepreneurs secure start-up loans of up to $100k

PUBLISHED ONMarch 08, 2024 12:00 AMBySophie Hong

PUBLISHED ONMarch 08, 2024 12:00 AMBySophie HongDespite strides towards gender equality, female entrepreneurs continue to face challenges in funding their start-ups.

This poses a significant hurdle - one which can hinder women-led businesses' potential for growth and innovation.

To address this disparity, OCBC is launching a new loan specifically for women entrepreneurs.

Rolling out in Singapore next month, the OCBC Women Entrepreneurs Programme will allow start-ups founded by women to secure financing of up to $100,000 within the first two years of incorporation.

The processing fees for such loans - which are 1.5 per cent of the loan amount - will be waived.

In addition to financial support, female entrepreneurs will also benefit from educational workshops, networking events and mentorship opportunities facilitated by the bank.

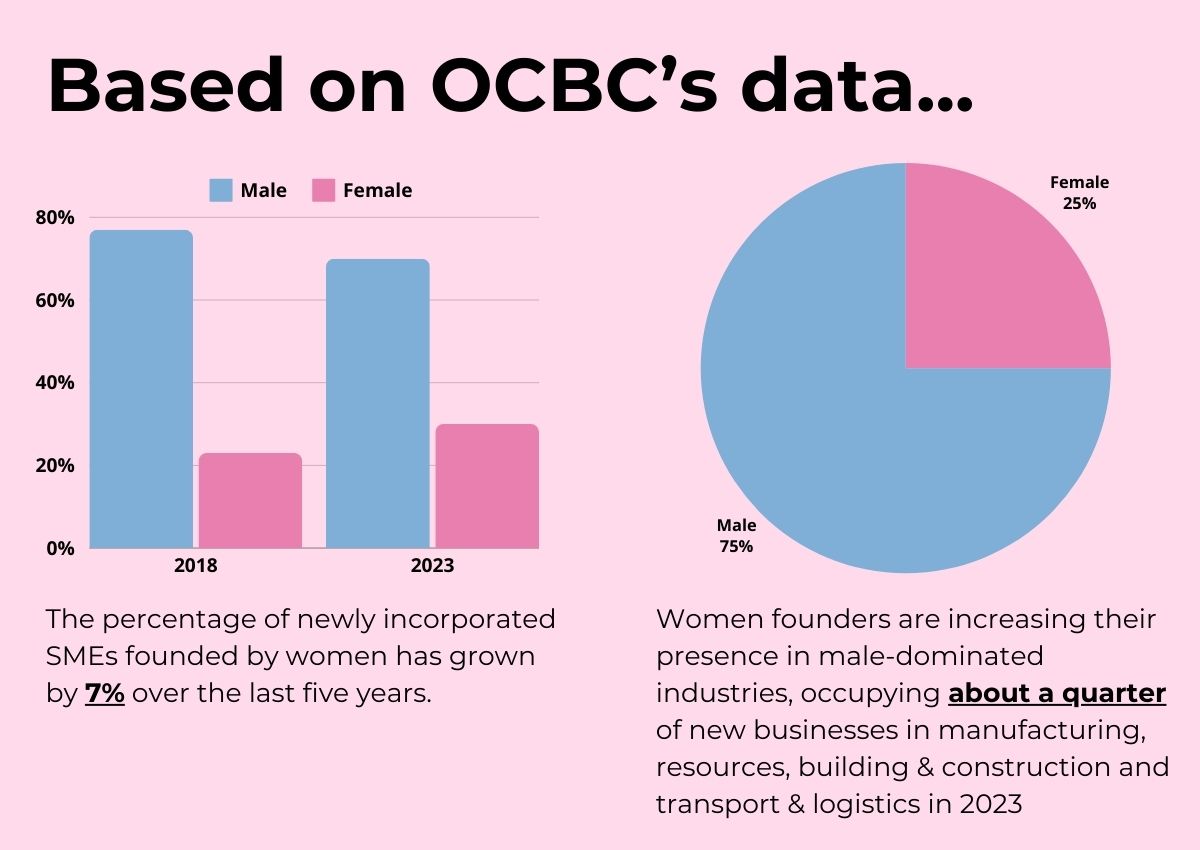

Speaking at a media briefing, OCBC's head of global commercial banking Linus Goh pointed out that even in a developed market such as Singapore, women-owned small and medium-sized enterprises (SMEs) account for only about 30 per cent of all businesses here.

"Through the OCBC Women Entrepreneurs Programme, we aim to empower women entrepreneurs to build the right connections, and to gain the resources and support needed to grow their companies to their full potential," Goh shared.

Didi Gan, founder of med tech company N&E Innovations, is all too familiar with the challenges of raising funds as a female entrepreneur.

Despite developing a non-toxic antimicrobial agent from food waste during the pandemic and earning over $800,000 in revenue from their flagship products in the first year alone, Gan and her female co-founder found themselves bootstrapping for the first two years of their business.

"It wasn't easy," Gan said, adding that they faced difficulties in securing funding.

Then, OCBC reached out in 2023 and granted N&E Innovations a green financing loan.

"That really helped our journey. Without that first loan, we wouldn't be where we are today," said Gan.

Browzwear, which provides 3D design software to fashion houses, is another female-led business that has benefitted from a close partnership with OCBC - and not just in terms of financing.

Founded in 1999, Browzwear's software allows fashion designers to create true-to-life digital samples of apparel designs, which results in time savings, lower costs, and less waste.

Its chairperson and former CEO Sharon Lim recalls a question from OCBC's leadership that prompted her to think - and act - bigger.

"We were in our fifth year. I was talking to one of the leaders of OCBC and he asked, 'You're growing at this pace. Have you ever asked yourself, what does it take to be a global market leader?'" she recounted.

She spent the subsequent weeks putting together a plan and consulting with OCBC.

"A couple of months later, I literally packed up my bags and moved to the US to start our business there," Lim said. She credits this move for putting Browzwear on the world map "in less than two years".

Her efforts paid off. Today, Browzwear is a leader in its field, with eight global offices - including in Europe and China - serving over 1,000 fashion and apparel companies worldwide. It generated more than US$20 million (S$26.74 million) in revenue last year.

While there definitely are examples of capable and successful businesswomen in Singapore, there is still an apparent gender gap.

"The statistics don't lie. [Women] still represent a smaller proportion of the economy," Goh stated.

In general, women-owned SMEs also registered a lower growth in sales turnover within the first three years of operations, according to OCBC's data.

But the good news is that women-owned businesses which tapped into financing to support their growth were able to bridge this gap.

"[Financing] basically just builds scale. If you're confident in what you're doing, what a loan does is give you capacity," Goh elaborated.

Another gap that OCBC has observed is that women entrepreneurs in the early stages of their start-ups tend to be younger than their male counterparts.

This has implications, especially in the realm of expanding into new markets or technologies, Goh pointed out.

"You could argue that the men, in a way, have a larger base to work with. They've got friends in the business, many of them may be repeat or serial entrepreneurs, and therefore they've had the opportunity to fail and come back," he said.

He added that female entrepreneurs might also encounter more gender-specific roadblocks when expanding beyond Singapore.

"It is precisely as they go beyond the borders of Singapore that you start to see many of the challenges that you typically associate with women being at the forefront of business, of innovation, of breaking norms in the industry."

"And that's what we want to be able to empower and support," he said.

sophie.hong@asiaone.com