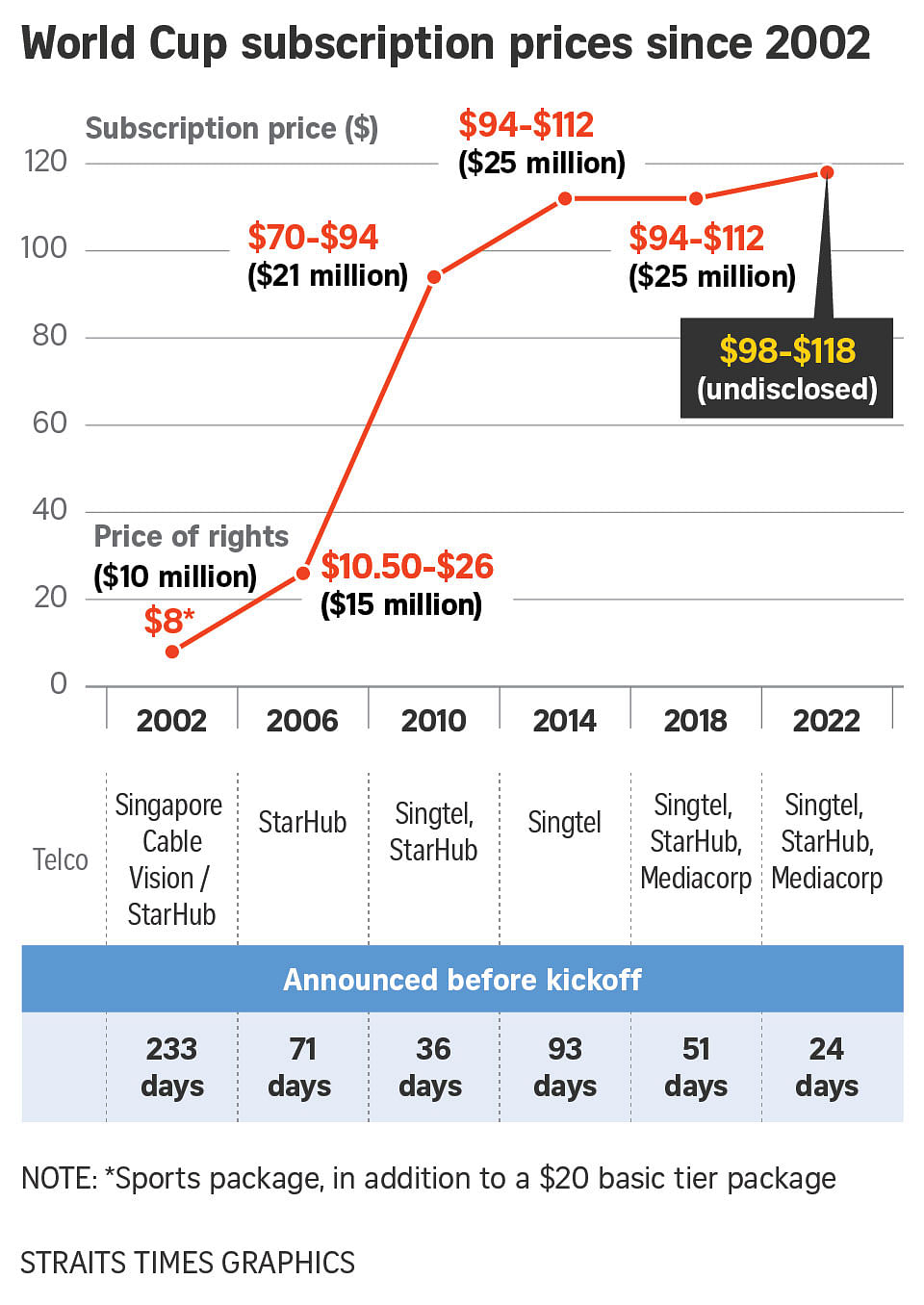

StarHub, Singtel and Mediacorp face challenges in recouping World Cup rights fee of over $25m

SINGAPORE - Even after a drawn-out negotiation process that led to the latest announcement of World Cup broadcast rights here, the three parties that hold the rights are not out of the woods yet.

The joint announcement by StarHub, Singtel and Mediacorp on Sunday comes just 21 days till Qatar 2022 kicks off. This means they now face a race against time to recoup the estimated rights fee in excess of $25 million that they had forked out to global football body Fifa.

Mr James Walton, sports business group leader for Deloitte South-east Asia, said that the two main methods of getting revenue for broadcasters of major sports events like the World Cup are selling subscriptions and advertising space.

But he believes the late announcement of the deal, as well as the unique timing of the Qatar World Cup, will affect the broadcasters’ ability to attract customers.

“Number one is, we are 21 days out, which means less time to raise awareness and less time to get people signed up,” he said.

“Then there is... the factor that the World Cup is happening halfway through a season. Traditionally, a World Cup would happen in June to July, so they are able to link it to Premier League (which kicks off in August) rights for the next season. But this is all already done... so it does reduce the option of how you attract people.”

The timing of games may also be an issue. Out of the 64 matches, more than half – 33 – kick off at midnight (Singapore time) or later.

Describing the late kick-offs as “not optimal” for Singapore viewers and advertisers, Mr Walton said: “The difference between this and the Champions League is that the Champions League is just one night a week, whereas the World Cup is happening pretty much every night for a month.

[[nid:603136]]

“And unless you have very generous bosses or very flexible work hours, staying up until three or four in the morning every single night to watch the games is difficult.

“That timing will affect whether people are willing to spend, and maybe even the format too, in terms of whether they choose to buy the whole package, or pick individual games, or (streaming) options.”

He added: “There are a few other opportunities (for revenue) in terms of hosting events and things like that, but principally those are the ways.”

While telecommunication companies can curate events to drive interest, broadcast rights holders are limited in terms of how much they can leverage the tournament.

“At the end of the day, the rights of the World Cup still belong to Fifa,” said Mr Walton. “You are not a sponsor, so you don’t have the activation rights sponsors have. So there is a limit to what you can do in terms of branded merchandise and all that.”

But Dr Seshan Ramaswami, an associate professor of marketing education at Singapore Management University, said that despite the obstacles, a “longer-term objective” for rights holders would be to improve the brand image of the broadcasters to audiences and advertisers.

He suggested that business-to-business (B2B) deals could be another opportunity for broadcasters.

Said Dr Ramaswami: “There will also be a lot of communal viewing in restaurants and sports bars, and that could be another source of revenue – the B2B market where the subscription fees could be a lot higher.”

For the 2018 World Cup, businesses that screened the action from Russia paid $3,090 for a standard screen package, and $2,020 for each additional screen. For screens larger than 50 inches, or 127cm, the price was $5,230 and $3,090 for each additional screen.

Still, Dr Ramaswami noted that a lot has changed in the media landscape since 2018, with streaming platforms like Netflix, Amazon Prime and Disney+ establishing themselves as go-to platforms for audiences, especially in the key demographic of “young consumers with large spending capacity on products and services offered by the largest advertisers”.

He added: “In this new landscape, and with the cross-carriage rules which prevent the ability to be an exclusive broadcaster in Singapore, it is going to be a lot more difficult to get secondary strategic advantages, especially cross-selling a contract for cable TV, and bundling of mobile, broadband and other services.”

This article was first published in The Straits Times. Permission required for reproduction.